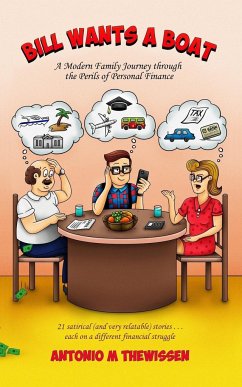

The perfect amusing storytelling read for anyone who wants to improve their personal finances - from teens and young adults, to experienced people looking for new money management tips. The funny and relatable stories in this book use storytelling as an innovative and effective way to teach personal finance lessons. Bill, Penny, and Florin Shillington's money anecdotes have been designed to teach and amuse at the same time. Bill is clueless with money but can't wait to retire. His wife, Penny, has a strong plan but needs to keep cleaning Bill's financial mess again and again. Their millennial son, Florin, has his own fresh take. In each of the 21 short stories, readers will gain insight on a particular area of personal finance, including: The difference between "good debt" and "bad debt" The attributes of "earned income," "portfolio income," and "passive income," and which one can enable you to quit your job Why leasing a car sounds like a great deal but isn't That buying a yacht may put a dent on your retirement dreams (maybe you knew this one already?) How to manage credit cards, reduce your tax bill, examine retirement plans, and much more! Besides relatable anecdotes, the book includes footnotes with academic observations and definitions, and bulleted lists of financial pointers, with the short stories connecting to build a bigger story in which the characters develop and evolve as the book progresses. COMPLETE LIST OF STORIES: THE OBLIVIOUS SAVER (on saving money) BILL WANTS A BOAT (on 'good debt' and 'bad debt') A LOW-SCORING GAME (on the credit score) DEBT FROM PLASTIC ISN'T FANTASTIC (on credit card debt) SHINY SLEIGH, EASY PREY (on predatory lenders and car loans) TO LEASE OR NOT TO LEASE (on lease vs buy) A STUDENT LOAN IN SHEEP'S CLOTHING (on student loans) A TALE OF TWO INSURANCE STRATEGIES (on insurance strategies) THE LOTTERY HOPEFUL (on thinking of lottery prizes as a retirement strategy) ONLY FOOLS GO ALL IN (on risky shares in the stock market) THE SUDDEN CASH AVALANCHE (on sudden cash windfalls) THE FIDUCIARY PRINTER SELLER (on the importance of fiduciary agents) THE TAX TAMER (on legal ways to reduce the tax bill) A TALE OF ANNUITIES, LONGEVITY, AND MONOPOLY (on annuities as a retirement vehicle) HOW WOULD YOU LIKE YOUR NEST EGGS? (on retirement accounts) THE PASSIVE BUT AGGRESSIVE INCOME (on the 3 types of income) THE UPSIZER REDEMPTION (on the credit card reward points) BILL VERSUS THE HOUSING MARKET (on the housing market) FLORIN THE MINIMALIST (on the financial benefits of minimalism) COMPOUNDING YOUR WAY TO RETIREMENT (on the power of compound interest) MONEY ISN'T EVERYTHING (on enjoying life) Cover Artist: Hey Os! - Oswaldo Hernández Nonato